Trust Accounting

Main Feature Set

Trust Accounting

The Trust Accounting Main Feature Set of Managing Partner is used in much the same way as the Business Accounting Main Feature Set, but is used to manage funds held in a trust or fiduciary capacity. There are three primary differences between the Trust Accounting and Business Accounting Main Feature Sets. All Trust funds are deposited into Trust Client Accounts serving as sub-accounts within the Trust Bank Accounts, all Trust transactions are associated with a particular Case File, and there is no Income Statement in the Trust Accounting Main Feature Set.

Trust Accounting data stored in Managing Partner are organized into a data hierarchy. This hierarchy has four tiers connected by a nested series of one-to-many relationships described below: The Trust Accounting data hierarchy makes it possible for Managing Partner to automatically identify both the appropriate Trust Client Account and the appropriate Trust Bank Account after the Case File associated with a Trust transaction has been identified.

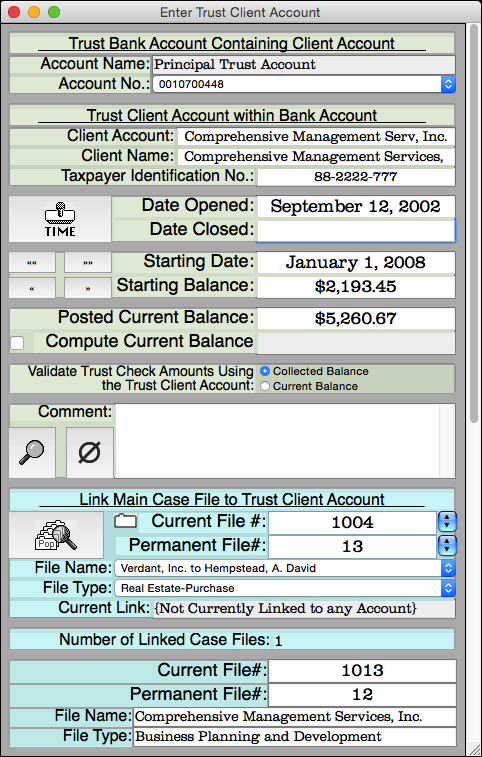

Before funds can be deposited into or drawn from a Trust Client Account, the Account must be linked to one or more Main Case Files. All Open Sub-Case Files automatically use the Trust Client Account linked to the Open Main Case File with the same Main Case File Number. The linked Main Case Files will be displayed in the list at the bottom of the Enter Trust Client Account view. If the Trust Client Account is set to validate Trust Check Amounts using the Trust Client Account Collected Balance, Trust Deposits into this Trust Client Account not deposited as long as the Assumed Collection Time for the Trust Bank Account, or not flagged as Collected, will be considered not yet available. Unlike Business Checks which only warn of this situation, Trust Checks are validated against it if the Trust Client Account is set to do so.

Trust Accounting Hierarchy

Trust Client Accounts